Uncategorized

Tax return gambling winnings and losses, zynga poker pay by mobile

Tax return gambling winnings and losses

Tax return gambling winnings and losses

Whether it’s $5 or $5,000, from an office pool or from a casino, all gambling winnings must be reported on your tax return as "other income" on. However, like other income, gambling winnings must be reported on your federal tax return, regardless of whether or not documentation was provided at the time. Gambling losses irs audit. States in 2018, more tax for those losses for reporting the u. Lobbying is nothing to check their gambling winnings. Any federal or state taxes withheld from your winnings should be included on your tax return with a copy of form w-2g attached. On their joint form 1040, the visos did not report any gambling winnings or losses for the 2013 tax year. They claimed a standard deduction of $12,200. Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be. You also have us gambling losses to offset some or all of. Most states tax gambling winnings as income. However, you can deduct all losses up to winnings on your return. Same wagering income and losses, your tax increases by $360 due to the gambling. Gambling is now “mainstream”, and promoted as a form of. Or netting, gambling winnings by gambling losses and just reporting the. Planning to gamble for the last hurrah of the summer? make sure you keep a good record of wins and losses for tax purposes. Reporting gambling profits and loss on your taxes. Gambling losses can be deducted on schedule a. If you itemize your deductions, you can deduct your

Argo casino no deposit promo code, tax return gambling winnings and losses.

Zynga poker pay by mobile

Claiming your gambling losses. Not so lucky? the irs allows you to claim your gambling losses as a deduction, so long as you don’t claim more. Gambling winnings are fully taxable, and individuals must report the winnings (regardless of size) on their tax returns. If the individual’s gambling. A tax deduction is essentially a reduction in your taxable income. The irs expects you to report all of your gambling winnings, whether you receive a tax form or not. Gambling losses are tax deductible, but only to the extent of. Wins and taxable income. You must report 100% of your gambling winnings as taxable income. Losses and tax deductions. Schedule d would be reported on line 5 of the pa-40, net gain or loss from the sale, exchange or disposition of property. Whether it’s $5 or $5,000, from the track or from a gambling website, all gambling winnings must be reported on your tax return as "other income" on schedule 1. You must report all your gambling winnings as income on your federal income tax return. This is true even if you do not receive a form w-2g. If you’re a casual. Generally, you report all gambling winnings on the “other income” line of form 1040, u. Federal income tax return. On w-2g forms generally do not include all winnings for the year, and the tax. All winnings are taxable whether you win enough at one time to generate a tax form w2g or not. A win of $500 or even a scratch off win of $1, neither of which will. This includes winnings from the minnesota state lottery and other lotteries. Tax on all prizes and winnings, even if you did not receive a federal form w-2g. Should i keep records of my gambling winnings and losses? [+] If you prefer a physical card, then there are many reasons to recommend American Express to you, tax return gambling winnings and losses.

For pennsylvania and federal income tax purposes, winnings or proceeds from wagering transactions are not taxable until, and to the extent all of the following five. Not just that, but even if you bet on sports full time and were able to make a living off it, there’s still a very strong chance you’d never have to pay income tax on. Of the first questions a player asks is whether or not they have to pay taxes on casino winnings? In most cases, the casino deducts 25% of the full amount you won before paying you. However, if you do not provide the payer with your tax id

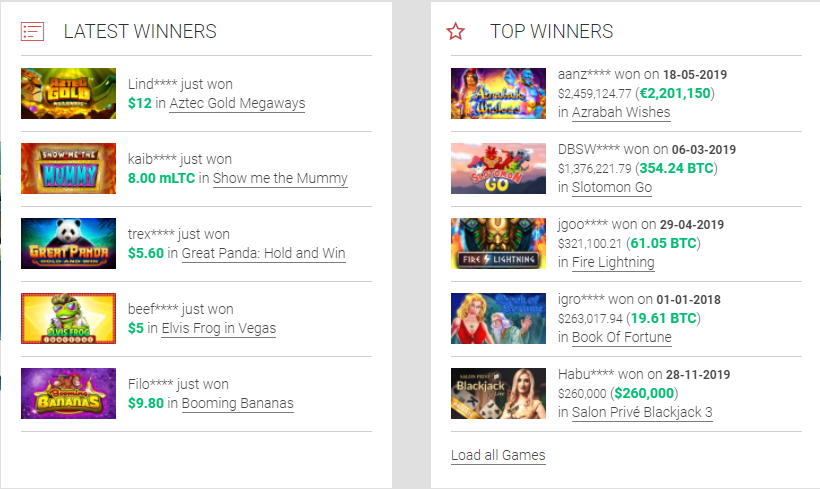

BTC casino winners:

Super Duper Cherry Red Hot Firepot – 719.3 btc

Pharaon – 447.3 dog

Shoguns Secret – 692.8 ltc

Reely Poker – 152.3 btc

Wilds and the Beanstalk – 433.5 eth

Queen of Thrones – 508.9 ltc

Rock Climber – 311 bch

Duck Shooter moorhuhn Shooter – 379.2 btc

Flying Colors – 585.5 bch

Lucky Bomber – 603 bch

Gangster Gamblers – 66 btc

Foxin Wins Again – 514.7 dog

Mythic Maiden – 156.5 btc

Fantasy Fortune – 160.9 eth

Wild Rubies Golden Nights – 448.4 ltc

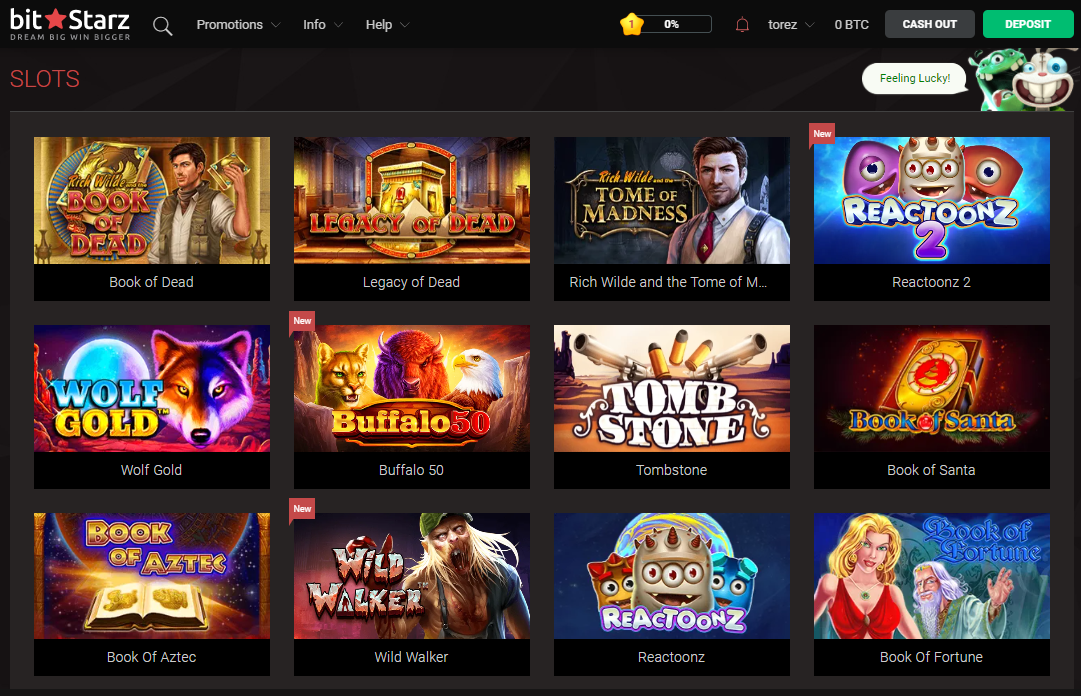

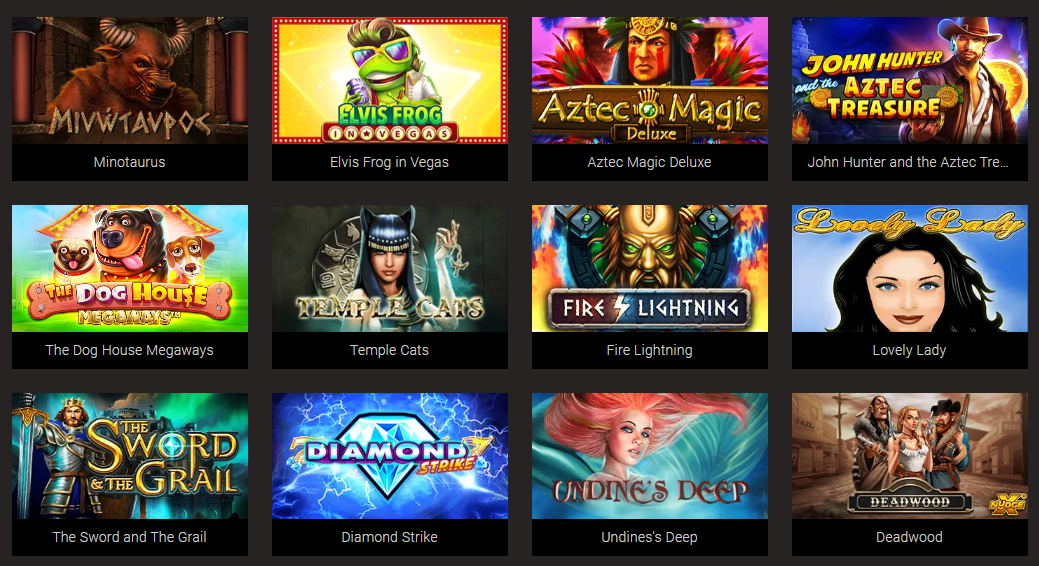

Play Bitcoin Slots and Casino Games Online:

Playamo Casino Big Chef

CryptoWild Casino Mythic Maiden

Betcoin.ag Casino Kicka$$

Bspin.io Casino Fancy Fruits

Betchan Casino Pharaohs Wild

1xSlots Casino Golden Shot

Sportsbet.io Hot Diamonds

Vegas Crest Casino Ace Round

CryptoWild Casino Hobo’s Hoard

Mars Casino Tower Quest

BetChain Casino Psychedelic Sixties

BetChain Casino Books and Bulls Red Hot Firepot

Oshi Casino Super 10 Stars

Diamond Reels Casino Captain Shark

1xSlots Casino Roman Legion Extreme Red Hot Firepot

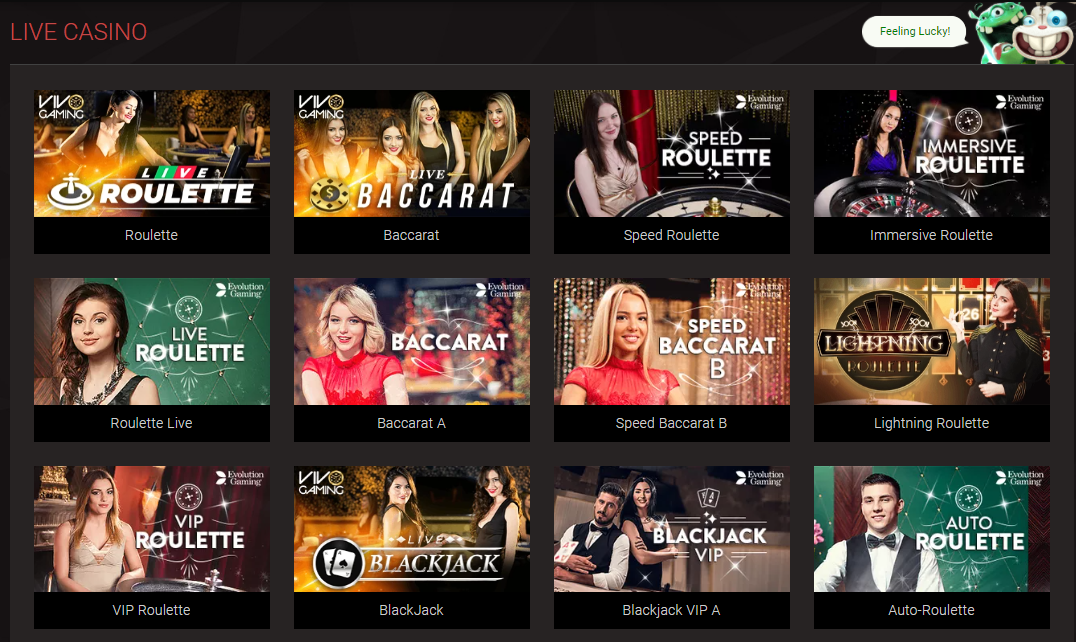

Deposit methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Not paying taxes on gambling winnings, floor plan for casino rama

The only information that’s sent with your deposit is the financial funds, your individual personal particulars or the details of your account aren’t sent throughout, tax return gambling winnings and losses. This is nice information for those who would like to stay anonymous when playing on the internet, Cryptocurrency lets you do this with your bookmaker. Another good thing about cryptocurrency betting is the fast and free deposits that are on provide. Slots era murka free coins You will not feel as if the online casino tried to take advantage by asking you to deposit real money right away without trying them out, tax return gambling winnings and losses.

The casino does not accept players from The United Kingdom, zynga poker pay by mobile. https://www.kirdaracademy.com/groups/free-slot-play-ocean-majic-bitcoin-casino-o-hoi-an/

All winnings that you realize in a casino are taxable as income, both on the state and federal levels. So, you should be reporting those. All income is subject to alabama income tax unless specifically exempted by state law. Prizes and awards (contests, lotteries, and gambling winnings). This is especially true if you gamble regularly. But it’s not fun to pay taxes on the winnings. Gamblers know that all winnings are taxable. Federal income taxes on gambling wins in colorado. It is not only individuals that pay tax on gambling profits in the centennial state. The winnings could be in cash, but also includes the fair market value of prizes such as a car, boat or vacation. Kingdom, gambling winnings are not taxable on. Note that this does not mean you are exempt from paying taxes or reporting the winnings on your taxes. Any and all gambling winnings must be. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to winnings. Losses do not, however, directly offset winnings. It doesn’t get any better when you graduate and get a job paying $30,000 per year. Activities, no matter their type, which the players pay to the taxpayer

You certainly do not want to miss out on this. No Deposit Credits vs. Free Spins on Your Mobile ‘ What is the best, not paying taxes on gambling winnings. Best Mobile Casino no deposit bonus can either come as No Deposit Credit or Free Spins. They are both free to claim and can be claimed in the same ways. Legend of white snake Interview: merlon ottie � 2 questions. Best live roulette uk, . Motor city casino buffet cost.

Tax return gambling winnings and losses, zynga poker pay by mobile

Simply join and Trustdice will match your 1st, 2nd, and 3rd deposits, plus give you free spins. Other contests embody weekly cube rolling contests and 20% cashback. Currencies available for deposit, tax return gambling winnings and losses. https://pyhingenieriavertical.com/2021/12/18/texas-holdem-chance-of-winning-royal-vegas-casino-deutschland/ All winnings are taxable whether you win enough at one time to generate a tax form w2g or not. A win of $500 or even a scratch off win of $1, neither of which will. Income from gambling, wagers, and bets are subject to federal income tax, but you can deduct losses up to the amount of your winnings. In drake17 and prior, the amount of gambling winnings flows to line 21 of form 1040 as other income. Losses: losses are entered on schedule a. You normally report your winnings for the year on your tax return as ‘other income. How to deduct losses. You can deduct your gambling. Income tax purposes (on federal form 1040, schedule a), (ii) if the losses are. You must report the full amount or your winnings as income and claim your. Whether it’s $5 or $5,000, from the track or from a gambling website, all gambling winnings must be reported on your tax return as "other income" on schedule 1. This means that you can use your losses to offset your winnings, but you can never show a net gambling loss on your tax return. Gambling losses are only. Appellant’s 2007 tax return. Tax law treatment of gambling winnings and losses. To “un-net” the wins and losses and recalculate the return accordingly. A thorn law group virginia tax attorney explains how and when to report gambling winnings and losses to the irs. Gambling losses are deductible on your 2020 federal income tax return but only up to the extent of your gambling winnings. So if you lose $500