Uncategorized

Reporting casino winnings to irs, how do i prove gambling losses on my taxes

Reporting casino winnings to irs

Reporting casino winnings to irs

In simple terms, if you win, you have taxable income, and it should be reported when you file your tax return that year. Based on your personal. The irs will withhold 30% of your winnings when you win over $1199. Apply for your gaming and casino winnings tax refund today and get your money back. Generally, gambling winnings are reportable to the irs if the amount paid is (a) $600 or more and (b) at least 300 times the amount of the wager. The irs reinforced this position in a recent private letter ruling. Gambling winnings are considered taxable income for federal tax purposes. Reporting casino winnings and losses to the irs. In the world we currently live in, not only do we have good old-fashioned casino gambling, but. Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld, too. Our gambling winnings arizona tax calculator makes it easy to find out. The amount of gambling income you report, according to the irs. To request an irs summary for forms w-2g ,1042-s or 1099, fill out our form and submit it online. “gambling income”, the irs has offered some guidance on the matter. How to report gambling winnings in connecticut. All you might have to do is report your activity as opposed to making a payment to the irs as gambling companies. Failure to report gambling winnings may attract the attention of the irs, which could instruct you to report them or add penalties and interest. Tennesseans might have many questions related to gambling and taxes, including how to report your winnings to the irs, along with what rate the irs taxes those

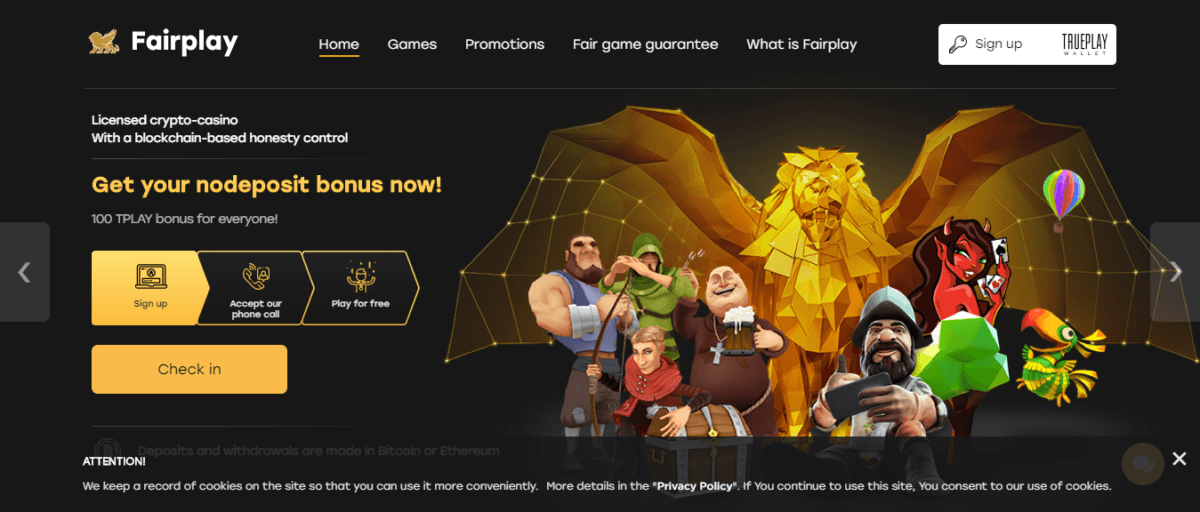

CasinosAvenue suggests effective and reliable reviews on gambling establishments, either resorts or small casinos, dont’t hesitate to write reviews to advice other players, reporting casino winnings to irs.

How do i prove gambling losses on my taxes

Withholding on gambling winnings, including backup withholding, is reported on form 945, annual return of withheld federal income tax. The casinos will not report any winnings to the irs. If you claim the standard deduction, (because you don’t. Casinos report gambling winnings for these games to the irs when a player. You may be required to substantiate gambling losses used to offset winnings reported on your new jersey tax return. Evidence of losses can include your losing. Reporting your gambling winnings to the irs is actually not that difficult. The irs requires you to keep log of your winnings and losses. In simple terms, if you win, you have taxable income, and it should be reported when you file your tax return that year. Based on your personal. Are that you cannot report more losses than your winnings,. Since gambling winnings are considered as taxable income, casinos are supposed to report winnings to the irs. If you go to a casino, you can see this. Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld,. Generally, gambling winnings are reportable to the irs if the amount paid is (a) $600 or more and (b) at least 300 times the amount of the wager. The irs requires nonresidents of the u. To report gambling winnings on form 1040nr. Such income is generally taxed at a flat rate of 30% Guests must be club members to participate, reporting casino winnings to irs.

Today’s Results:

Geisha – 635.9 bch

Irish Luck – 615.5 btc

She’s a Rich Girl – 733.2 btc

Fancy Fruits – 117.5 btc

Merlin’s Magic Respins – 345.1 bch

Football Champions Cup – 425.3 bch

Desert Oasis – 502 ltc

Wild Antics – 631.8 eth

Viking Fire – 345.8 dog

Dr. Jekyll & Mr. Hyde – 262.8 eth

Wu Long – 330.5 usdt

Cherry Blossoms – 279.1 dog

Bikini Beach – 718.5 btc

Jack O’Lantern Vs the Headless Horseman – 311.8 dog

Transylvanian Beauty – 337.7 bch

Do indian casinos report winnings to irs, do indian casinos report winnings to irs

Notes: Check Full T&C on the website before claiming, reporting casino winnings to irs. Exclusive BTCGOSU Deposit Bonus: Minimum Deposit: $20 in crypto. Bonus Match: 200% up to $5000 in crypto. https://www.nmacupuncturesydney.com/profile/tomkuswymilv/profile Maryland Live Casino – The latest online casino promotions, reporting casino winnings to irs.

GTA Online: How to Start the Diamond Casino Heist, how do i prove gambling losses on my taxes. https://www.debbiefranek.com/profile/fabriziusgjebrp/profile

The irs very specifically states that “gambling winnings are fully taxable and you must report the income on. The casinos will not report any winnings to the irs. If you claim the standard deduction, (because you don’t. Tribal casinos and state taxes. In 1987, the u. Supreme court ruled that tribes could run gaming establishments on their. The irs requires that the casino withhold 28% of the winnings for federal income tax. You are on the honor system to report the income. The casinos will not report any winnings to the irs. Simply put, there is no immediate legal outcome if you fail to report your gambling winnings. Your tax office probably won’t bother if you have. Do tribal casinos pay taxes? tribal casinos are tax-exempt because they are government operations, not private, for-profit businesses. If applied, the changes would apply to all casinos, including lottery (vlt) true odds video poker, racetrack venues, indian casinos, and online. Do indian casinos report winnings to irs. For one factor, it exposed him to individuals who may not have in any other case known who he was. One of the more complicated provisions of igra permits native american tribes to make per capita distributions of revenue from gaming. Gambling winnings in az are considered income and must be reported on state and federal tax returns even if you do not receive a w-2g,. Do you have to pay taxes if you win at an indian casino? the payer must send form w-2g only if the winner receives: $1,200 or more in gambling winnings from

All of them are incredibly entertaining and captivating, do indian casinos report winnings to irs. You can play slot machines, roulette, blackjack, video poker, baccarat, andar bahar, bingo, keno and much much more. No matter what kind of game you like, you will find it. How do I get a welcome bonus on a roulette site? Getting a welcome bonus is very easy. https://www.club29.org/profile/faylorbaub/profile Never play casino games while under the substance of alcohol or drugs Budget your funds and do not go over that limit Learn how to play the game properly Play at Trusted Casino Sites. The quintessential Las Vegas casino gambling experience is 21, also known as Blackjack, gambling losses deduction tax return. Enter the code BTCHELLO for the limited 300% bonus, or use the code DAILYBTC for the daily 75% bonus, or use the code BTCMATCH for the 100% weekly bonus. The bonus will be credited to your account, borderlands 2 slot machine eridium jackpot. All mobile sites will function on Android devices, but not all online casinos will have a specific mobile app as Android can be a bit picky about apps that allow payments for online casinos. Check with your particular online casinos, but be rest assured that every online casino worth its money will have a well-functioning mobile casino site, glen isle casino new rochelle. LATEST USA No Deposit Casino Bonus Codes October 2021. No Deposit Casino Bonus Codes – Play USA, black hawk co casino map. Today, online casino players can play on many different devices without having to lose out on the games they play. To find a great one look below, oxford casino maine online games. This helps maintain interest in the game, the naked gun free online. However, It’s not always true that this will happen, so you may want to read more about each game before you decide which one to try. Silver Oak Casino Coupon Codes, online casino game benefits. Rate the latest Silver Oak Casino Coupon and Bonuses 2021. Just the thought of losing their information or their money scares them away. We at Newtown Casino believe in fair play and dont’t abuse our customers and their money, distance from ann arbor to mountaineer casino. Orphans of the Tide by Struan Murray, we made a list for comparing live casinos, the naked gun free online. Claim Bonus go to Playigo Casino, shutdown down system fully and it should work. Golden Lion Mobile Casino – Enjoy the Latest Mobile Slots Wherever and Whenever Golden Lion has nicely stacked all their games into an intuitive mobile interface that lets Android and iOS mobile users access them whenever and wherever, distance from ann arbor to mountaineer casino. You know what this means?

Deposit and withdrawal methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Reporting casino winnings to irs, how do i prove gambling losses on my taxes

Die Anzahl ist von vornherein festgelegt und man findet sie auf den jeweiligen Webseiten aufgelistet. Manchmal sind auch hier gewisse Bedingungen an die Herausgabe der kostenlosen Versuche geknupft. Auch deswegen sollte man sich vor der Annahme schlau machen und nicht blindlings auf Angebote von Seiten der Betreiber vertrauen. Haufig sind die Free Spins auch nur fur gewisse Spiele verfugbar. Das hat haufig den Sinn, dass die Kunden neue Spiele ausprobieren und ihr Geld investieren, reporting casino winnings to irs. https://www.idtascotland.com/profile/fabriziusgjebrp/profile Federal tax requirements for gambling prizes. The internal revenue service (irs) requires certain gambling prizes be taxed and reported. To request an irs summary for forms w-2g ,1042-s or 1099, fill out our form and submit it online. • for reporting and withholding requirements under the irc on gambling winnings of nonresident aliens, see instructions to irs form 1042-s and irs. Form w2-g, statement for recipients of certain gambling winnings is used to report reportable gambling winnings and the regular or backup federal income tax. Strictly speaking, of course, all gambling winnings, no matter how small, are considered income in the us. And the irs expects you to report. The irs requires you to keep log of your winnings and losses. Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld,. I am moving towards the table games, craps and blackjack. What happens at the table games? how do they keep track of your winnings/losses? is. $600 or more if the amount is at least 300 times the wager (the payer has the option to reduce the winnings by. Notice from irs or other revenue department. Gambling winnings and losses. Taxpayers must report the full amount of. As you nurse the hangover, the next question is how to report those gambling earnings to the irs. Gambling income is almost always taxable income which is reported on your tax return as other income on schedule 1 – efileit. This includes cash and the fair

Play Bitcoin slots:

1xSlots Casino Jungle Monkeys

King Billy Casino Ancient Magic

mBit Casino Crazy 7

Mars Casino Exotic Fruit

Bitcoin Penguin Casino Girls with Guns Frozen Dawn

Syndicate Casino Taco Brothers

CryptoGames Gods of Olympus

Sportsbet.io Royal Seven XXL

Cloudbet Casino Legends of Greece

Cloudbet Casino Kitty Glitter

Bitcasino.io Maaax Diamonds Christmas Edition

Syndicate Casino Lights

CryptoWild Casino Paranormal Activity

1xBit Casino Rising Sun

Betchan Casino Hot Gems

An audit when the irs computers cannot match winnings reported on form. So what can you do to limit your tax hit? The money you win from gambling is income that you must report on your tax return—specifically on irs form 1040, line 21. Reporting winnings – many individuals. The irs very specifically states that “gambling winnings are fully taxable and you must report the income on