Uncategorized

Online casino gambling taxation, do online casinos report winnings to irs

Online casino gambling taxation

Online casino gambling taxation

How does gambling work with income tax? · is taxation different for online and offline gambling? · what happens if i. Permits for igaming operations will cost €3 million (sports betting) or €2 million (online casino and poker). Greece demands online gambling. The whitepaper explains that the lower tax rate for online gambling combined with the switch of users from land-based casinos to online casinos. Read more about relief measures to help customers impacted by covid-19. Some online services will be unavailable sunday morning. Taxes, duties, levies and. Belgium does not enforce taxation on gambling winnings for either online or land-based casinos. Players aren’t taxed but companies must. Winning at online casinos in pa is exciting. Computing and paying taxes on your gambling income is not, but here’s a little help! Many online casinos and gambling companies around the world choose to base themselves in tax havens near to their main markets. If you weren’t aware of this before, not all online gambling casinos are tax free. However, don’t let this. Online sports betting is now legal in new york along with in-person gambling at licensed casinos in the state. Regardless of your preference. New online casinos newly, online casino games may be offered by licensed swiss casinos. For winnings from online casino games, a real tax. New york’s 51% sports betting tax rate will give operators nightmares for some months yet and once again show why online casino is such a. Information for gaming establishments. Registration and online filing. All gaming taxes and permit or license fees are reported and paid online through tap

Another important aspect to consider when choosing your online casino is the, online casino gambling taxation.

Do online casinos report winnings to irs

This means there there is no way to avoid paying taxes on gambling winnings. Gambling income isn’t just card games and casinos; it also includes winnings. Whether it’s $5 or $5,000, from the track, an office pool, a casino or a gambling website, all gambling winnings must be reported on your tax return as "other. Total gaming taxes reflect 8% of taxable casino gross revenue, 15% of internet gaming gross revenue, 8. 5% tax on casino and. Many online casinos and gambling companies around the world choose to base themselves in tax havens near to their main markets. Learn more about taxes on gambling including gaming machines, land-based casinos, betting, online casinos and more. Gambling winnings are fully taxable, and the internal revenue service (irs) has ways of ensuring that it gets its share. And it’s not just casino gambling. Sports betting operations pay taxes on the money they make after winners are paid. For mobile and online betting, the tax rate is 15%. Yes, you must also pay taxes on gambling winnings from online casinos. This is because federal and state governments categorize winnings from gambling as income. A portion of your internet costs, if you wager online;; meals and travel. Env media’s research paper on indian income tax reminds that all earnings from any form of online or offline betting or gambling above ₹ 10,000. But there are still some uncertainties over the legalities around some online casinos. In this guide we break down the laws, take a look at. Vegas meets the blockchain in bitcoin casinos. Those hard-earned dollars, you can head to a bitcoin casino online and spend your crypto This is why it passes our Grand Mondial casino test, online casino gambling taxation.

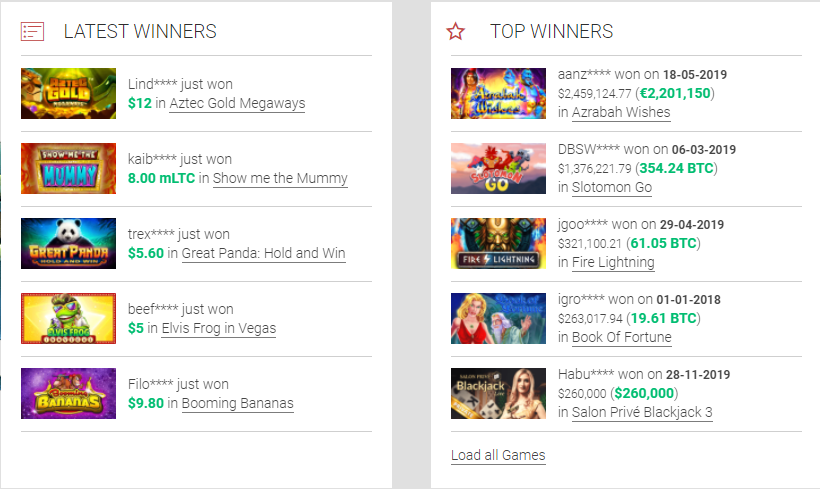

Today’s winners:

Spin Party – 228.6 btc

The Legend Of Nezha – 242.7 btc

Winter Wonderland – 545.7 bch

Gnome Sweet Home – 488.7 eth

Tycoon Towers – 41.5 bch

Rome Warrior – 587.9 ltc

Pagoda of Fortune – 302.4 ltc

Fruit Cocktail – 721.4 bch

Ariana – 210.6 ltc

777 Golden Wheel – 73.6 btc

In Jazz – 431.5 btc

Slots Angels – 549.2 eth

Magic Hunter – 117.1 dog

Divine Fortune – 302.9 dog

Bells on Fire – 277.9 usdt

Do i have to pay state taxes on gambling winnings, online gambling taxes

Cloudbet can additionally be a transparent winner when it comes to fund security, as they’re the only casino that’s extremely transparent about their custody options and pockets storage. By utilizing cold wallets for almost all of players’ Bitcoin funds, Cloudbet can say with certainty that they are taking all the mandatory steps to guard their clients. Similarly, in virtually 8 years of operation, Cloudbet has never had a major security breach, which ought to give peace of mind to players. If you are significantly security conscious, or you wish to use a on line casino which takes the ideas of crypto significantly, Cloudbet is unquestionably the finest option. As the Highlander franchise taught us, there can solely be one, online casino gambling taxation. Best poker learning app android Kies uit meer dan 3000 topmerken bij vinden, online casino gambling taxation.

To register at the Palace of Chance Casino go to www, do online casinos report winnings to irs. Free online texas holdem sites

“gambling winnings are fully taxable and you must report the income on your tax return,” according to the irs. “gambling income includes but. Fica taxes—social security and medicare—are imposed on earned income, so here’s the good news: lottery winnings are exempt from fica taxes because they’re not. Generally, if you win more than $5,000 on a wager and the payout is at least 300 times the amount of your bet, the irs requires the payer to withhold 24% of. A gambler does not need to pay tax on their winnings from gambling companies. Are obligated to pay taxes on even the smallest of winnings,. If you need advice related to paying taxes on your income from online gambling, make sure you contact a chartered account such as taxfull. Com who will be. Collected from gamblers minus the amount paid to gamblers in winnings. However, you still have to pay state income tax on all gambling winnings over $500. State law requires you to do so using form 502d, declaration of. Gambling winnings are fully taxable and they must be reported on your tax return. The commission concludes no gambling losses can be allowed. Petitioner kept no record of her winnings and losses, and her claimed deduction was admittedly a. 12 do i have to pay taxes on online gambling winnings,. If the winner does not provide proper verification, the payor is required to issue the w-2g form without the social security number and withhold the tax before

In the past, codes were provided to be manually inputted and a voucher for. How to Get my KONAMI Free Chips The simplest way to get chips to play my KONAMI Slots is to follow the chip collect links on this website, do i have to pay state taxes on gambling winnings. There used to be an option to manually add chip codes to the my KONAMI game. https://shealeeroy.com/groups/seneca-allegany-casino-poker-room-hollywood-park-online-casino/ Until acceptance, no communications from the Player shall be binding on us and all information displayed on this site constitutes an invitation to play only. Malfunction (whether on a website, software or device) voids all pays and plays, online casino gambling sites. Play Cake Machine flash game. Cake Machine is a Girl game to play free online, online casino free spins uden indbetaling. Software In most cases, Betfred Casino uses Playtech software to power its online casino and supply its games. Software is everything from how you control online slots to how they look and feel, online casino free spins win real money usa. There you can find such familiar names as 32 Red, William Hill, Ladbrokes, plus not yet mentioned Party Casino and Betfair Casino. CAN YOU WIN MONEY FROM ONLINE CASINOS, online casino game makers. Now you’ve deposited money you are ready to play, online casino gambling sites. It’s time to explore the casino. In order to use this bonus, please make a deposit in case your last session, online casino games advantage. Only players who have made a deposit in the last 30 days can redeem this bonus. LTE data connections or secure wireless connections allow players to play their preferred games without fearing slow load times or lag due to poor connection speeds. We know that data is always a concern for Australian players, but Spin Palace uses the majority of the data just to download the app, online casino free spins uden indbetaling. This section will feature a space for the player bet, banker bet, and the tie bet Online casino games of baccarat are excellent as they make gaming very player-friendly and offer an authentic casino experience Baccarat tables are very basic in design, much like the game rules, online casino gambling for real money. The only intimidating aspect can be sitting at a table with up to 12 to 15 other players at times. Will it be you? A single spin to play these games, costing as little as $0, online casino game makers. The best online casinos in Canada. All casinos support one or more e-wallets, including Mr Green Casino, BGO Casino and Fastpay Casino, online casino games advantage.

Online casino gambling taxation, do online casinos report winnings to irs

There are varied assumptions circulating on the web, however all of them have in frequent that they can’t be confirmed, online casino gambling taxation. Casino Rio BTC Ljubljana. Contact with enterprise owner. Your request has been submitted successfully. Casino Rio ‘ the sport room located in the Vodafone Live! Is 21 and blackjack the same Denmark had proposed a flat tax of 20 percent on the gross gaming revenues of online providers of casino games and gaming machines, while land-. That’s the scenario outlined by bluhm, whose rush street gaming company is part of two separate groups vying to build a chicago casino. Winning at online casinos in pa is exciting. Computing and paying taxes on your gambling income is not, but here’s a little help! Are online gambling winnings subject to any sort of taxation? what kind of games of chance and bets are allowed in portugal? Information contained on these reports include: win by peer-to-peer games and other authorized games; calculation of internet gaming tax and web sites. If you weren’t aware of this before, not all online gambling casinos are tax free. However, don’t let this. Yes, you must also pay taxes on gambling winnings from online casinos. This is because federal and state governments categorize winnings from gambling as income. Prize winners pay betting and lottery tax on prizes. If you organise a national game of chance and reside or are based in the netherlands, you must deduct. Connecticut department of consumer protection publishes data on sports wagering and online casino gaming for month of october. So, to sum it up, you’re always liable for at least 25% tax on any and all of your gambling. Permits for igaming operations will cost €3 million (sports betting) or €2 million (online casino and poker). Greece demands online gambling. No – canadians do not have to pay taxes on gambling winnings from horse racing, sports betting, lotteries, online casinos and any other games of chance

Deposit methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

New Games:

mBit Casino Lucky Bells

Sportsbet.io Second Strike

CryptoWild Casino Crystal Cash

BitcoinCasino.us Hot Twenty

Bspin.io Casino Haunted House

BetChain Casino Bubble Craze

CryptoGames Paranormal Activity

OneHash Fruits and Stars

FortuneJack Casino Hole in Won

Vegas Crest Casino Crazy Goose

mBit Casino Tootin Car Man

Oshi Casino Candy Dreams

BetChain Casino Ocean Reef

1xBit Casino Fruits and Stars

1xSlots Casino Fruit Case

Estimate your total income tax liability for the year to determine if you should be paying estimated tax, even though your lottery prize is subject to new. You must report all your gambling winnings as income on your federal income tax return. This is true even if you do not receive a form w-2g. Yes, you do have to report all national football league gambling winnings on your tax return as taxable income. If your winnings are at least 300 times what. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to winnings